Trade and tariff policies dominate national headlines, but their effects on the irrigation industry are less visible — and increasingly important to understand. This article will look at data on imports and analyze potential impacts from recent tariff news.

Bottom-line observations for irrigation equipment imports:

- The value of U.S. imports of self-propelled center pivot irrigation equipment is limited compared to other irrigation equipment.

- Imports from the China and Mexico alone make up 70% of total U.S. imports of other agricultural and landscape irrigation equipment, which makes U.S. tariff policy on imports from for these two countries the most important to focus on.

- Other than the imports from the Dominican Republic, no other countries exceed $10 million during this 12-month period.

- Imports make up a relatively small fraction of total domestic irrigation equipment and services economic activity.

Data from July 2024 to June 2025

The following data, organized and tracked by Harmonized Tariff Schedule (HTS), are from the U.S. Census Bureau’s USA Trade Online for the most recent 12-month period for which data is available, July 2024 through June 2025.

-

- 8424.82.0010 – Self-Propelled Center Pivot Irrigation Equipment

- Total – $5,749,050; further analysis not conducted given the low volume of imports

- 8424.82.0020 – Other Irrigation Equipment for Agricultural or Horticultural

- 8424.82.0010 – Self-Propelled Center Pivot Irrigation Equipment

| July 2024 to June 2025 | |

| Total Imports | $132,570,829 |

| Mexico (1st) | $95,647,911 |

| China (2nd) | $10,838,059 |

| Dominican Republic (3rd) | $7,765,172 |

| Israel (Noteworthy) | $2,141,532 |

| Remaining countries combined | $16,178,155 |

-

- 8424.82.0090 – Other Agricultural or Horticultural Spraying and Dispersion Equipment

| July 2024 to June 2025 | |

| Total Imports | $47,694,841 |

| China (1st) | $25,409,964 |

| Taiwan (2nd) | $4,954,093 |

| Italy (3rd) | $2,897,130 |

| Israel (Noteworthy) | $2,407,282 |

| Remaining countries combined | $12,026,372 |

Overall size of the irrigation domestic markets and export markets

Data from the 2020 IA report titled “Economic Impact of the Irrigation Equipment and Services Industry” (Economic Impact Report) is helpful for providing context on the size and scope of the import market, the domestic market and the export market. The Economic Impact Report and the HTS codes are categorized differently, the Economic Impact Report combined the cost of equipment with the cost of related installation services, and the years of comparison are different. Nonetheless, these numbers from the Economic Impact Report represent the best available data and they still offer a good sense of scale.

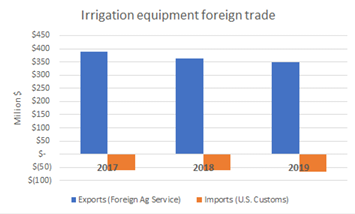

Consistent with the data in this article and the prior article on exports, the Economic Impact Report showed that the irrigation industry is a net exporter of equipment. This is captured in Figure 13 from the Economic Impact Report (see below).

Looking at the data from 2020 in the Economic Impact Report, here is the relative size of the market for irrigation equipment and services:

| Crop Irrigation | $2,377,000,000 |

| Residential and Commercial | $6,203,000,000 |

| Landscape & Horticultural | $55,760,000 |

| Net Exports | $284,000,000 |

| Total | $8,919,760,000 |

Trade and tariff policies to watch

Viewed overall, imports from China and Mexico make up a meaningful portion of the overall irrigation equipment market. As of August 2025, U.S. tariffs on imports from China remain capped at 30% under a temporary 90-day truce that extends through Nov. 10, 2025, while China’s tariffs on U.S. goods are capped at 10%. High-level talks continue, with Chinese negotiators scheduled to meet in Washington later this year. While the future of Chinese tariffs remains uncertain, the 30% tariff level is not significantly higher than the average tariff rate under President Biden.

As of mid-2025, the U.S. has applied 25% tariffs on many imports from Mexico, though the USMCA framework ensures that roughly 84% of Mexican exports still enter the U.S. duty-free when they meet the agreement’s origin and compliance rules. This balancing act—tariffs on one hand, exemptions under USMCA on the other—has kept North American supply chains largely intact but created uncertainty for sectors reliant on Mexican components and finished goods. Looking ahead, the mandatory USMCA review in 2026 will be a pivotal moment for U.S.-Mexico trade relations, with both governments already consulting stakeholders to determine whether the pact will be reaffirmed, adjusted or face greater political friction.

Other countries may be important for certain products or manufacturers, but on a macro scale they are unlikely to have a significant impact on the irrigation industry as a whole. The IA, nonetheless, is being watchful for strategic opportunities to engage with noteworthy countries for U.S. irrigation equipment imports.